Debt structure

Sandvik's debt structure includes:

- Bonds, Medium-Term Notes (MTN)

- Bank loans

- Commercial papers

| Outstanding amount |

Equivalent in MSEK |

||

|---|---|---|---|

| Long term | 88% | ||

| Medium-Term Notes MSEK |

0

|

0 | |

| Medium-Term Notes MEUR |

1,752 MEUR

|

18,931 | |

| Bank loans MUSD |

0

|

0 | |

| Bank loans MEUR |

800 MEUR

|

8,643 | |

| Bank loans other |

91 MSEK

|

91 | |

| Short term | 12% | ||

| Commercial paper MSEK |

0 MSEK

|

0 | |

| Commercial paper MEUR |

0 MEUR

|

0 | |

| Medium-Term Notes MSEK |

0 MSEK

|

0 | |

| Medium-Term Notes MEUR |

350 MEUR

|

3,781 | |

| Bank loans other |

28 MSEK

|

28 | |

| Back-up facilities | |||

| Revolving Credit Facility MSEK | 0 MSEK | 0 | |

| Credit Facility MEUR | 0 MEUR | 0 | |

| Total | 31,474 | ||

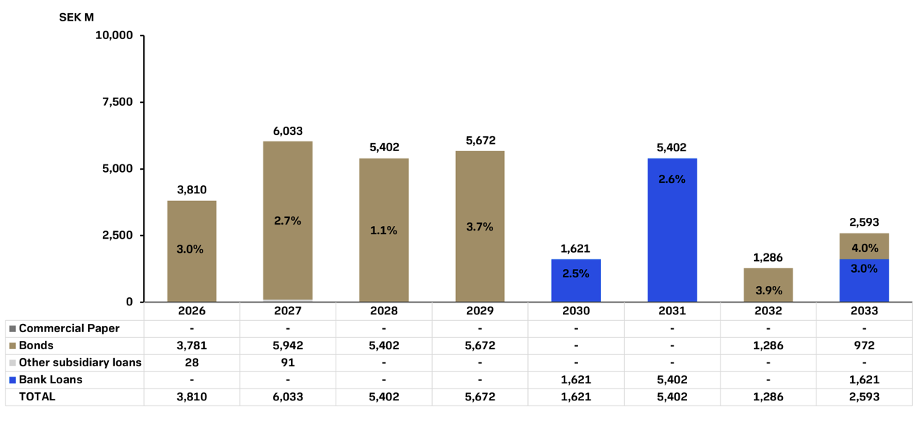

Loan maturity profile December 31, 2025

| Type of debt | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 |

|---|---|---|---|---|---|---|---|---|

| Commercial paper | - | - | - | - | - | - | - | - |

| Bonds | 3,781 | 5,942 | 5,402 | 5,672 | - | - | 1,286 | 972 |

| Other subsidiary loans | 28 | 91 | - | - | - | - | - | - |

| Bank loans | - | - | - | - | 1,621 | 5,402 | - | 1,621 |

| Total | 3,810 | 6,033 | 5,402 | 5,672 | 1,621 | 5,402 | 1,286 | 2,593 |